India and Singapore have linked payment systems to disrupt cross-border remittances, the Unified Payments Interface (UPI) of India and PayNow. This would help in faster and low-cost fund transfers.

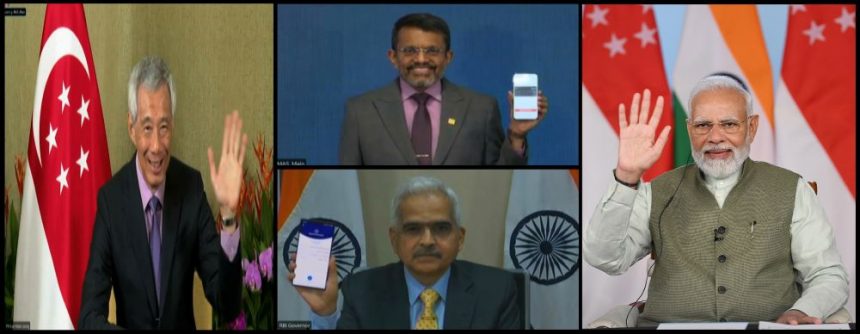

Indian Prime Minister Mr. Narendra Modi and Singapore Prime Minister Mr. Lee Hsien Loong participated in the virtual launch of UPI-PayNow Linkage.

“UPI PayNow Linkage will make Cross Border Remittances Easy, Cost-Effective and Real Time,” stated a press release.

Reserve Bank of India Governor Mr. Shaktikanta Das and the Monetary Authority of Singapore, Managing Director, Mr. Ravi Menon, made live cross-border transactions with each other using their respective mobile phones.

Singapore is the first country with which cross border Person to Person (P2P) payment facility has been launched.

“This will help the Indian diaspora in Singapore, especially migrant workers/students, and bring the benefits of digitalisation and fintech to the common man through an instantaneous and low-cost transfer of money from Singapore to India and vice-versa,” added the release.

To begin with, the State Bank of India, Indian Overseas Bank, Indian Bank and ICICI Bank will facilitate both inward and outward remittances while Axis Bank and DBS India will facilitate inward remittances. For Singapore users, the service will be made available through DBS-Singapore and Liquid Group.

Daily Limit

More banks will be included in the linkage over time.

Customers of participating banks can undertake cross-border remittances to Singapore using the mobile banking app or internet banking.

To begin with, an Indian user can remit up to ₹60,000 in a day (equivalent to around SGD 1,000).

“At the time of making the transaction, the system shall dynamically calculate and display the amount in both the currencies for the convenience of the user,” said RBI in a release.

Acceptance of UPI payments through QR codes is already available in selected merchant outlets in Singapore.

The linkage of these two payment systems would enable residents of both countries to transfer cross-border remittances faster and more cost-efficient.

Leave a Reply