The value of investments by Private Equity – Venture Capital (PE-VC) firms in India fell by 38% to less than $30 Billion in 2023.

A recent report by data and analysis provider Venture Intelligence PE-VC firms invested $29.7 billion in Indian companies in 2023 as against $47.6 Billion a year ago. In the year there were around 756 deals while the same was 1,362 deals in the previous year.

“These figures exclude PE investments in Real Estate,” the firm said in a blog post.

The year 2023 witnessed 67 mega deals worth $21.2 billion, compared to 112 such investments worth $31.8 billion in 2022. The company classifies investments to the tune of more than $100 million as mega deals.

“While large ticket PE investors focused their attention towards sectors like Healthcare, Financial Services and Infrastructure, 2023 saw the slowdown in Growth- and Late- Stage investing trickle into the Venture Capital segment as well,” said Arun Natarajan, Founder of Venture Intelligence.

Temasek’s and TPG capital’s investment worth $2.4 billion in Manipal Hospitals was the largest PE-VC investment in 2023. This was followed by the $1.35 billion buyout of education loans focused HDFC Credila by Baring Asia and ChrysCapital and the $1 Billion investment by Qatar Investment Authority (QIA) in Reliance Retail.

New Unicorns

“2023 saw just 2 Unicorn companies being created, compared to 21 in 2022. Quick commerce startup Zepto and consumer & small business loans firm Incred Finance were the two companies.”

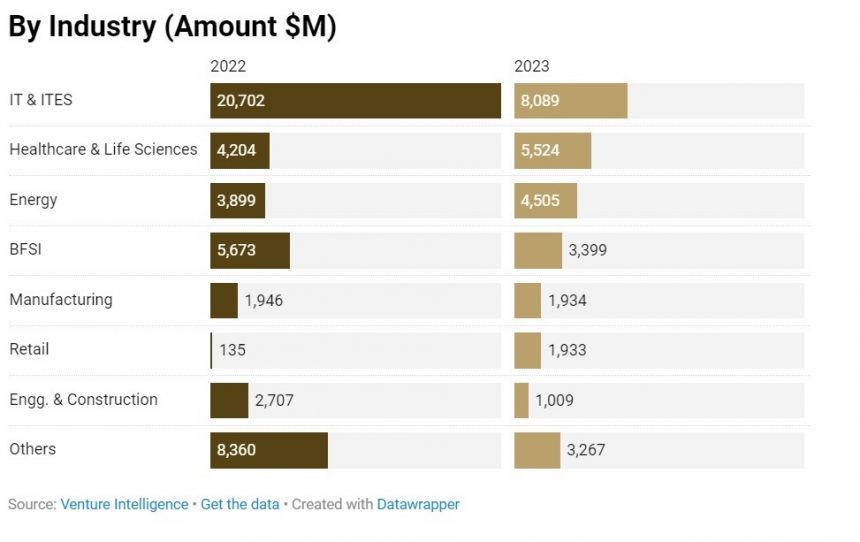

IT & ITeS companies accounted for $8 billion of the total PE-VC investment pie in 2023, a 61% decrease compared with 2022. The Healthcare and Life Sciences industry attracted $5.5 billion during 2023 – a 1.3x increase from the $4.2 billion raised during the previous year. The Energy industry saw $4.5 billion worth of investments in 2023 – a 1.2x increase compared to the $3.9 billion invested in 2022.

“Towards the year-end, on the back of the strong public markets, private markets received a dose of optimism, which also translated into a few large growth stage tech investments going through,” added Mr. Natarajan.

Click here to read the blog.

Leave a Reply